34+ mortgage tax deduction calculator

The interest paid on a mortgage. Use this calculator to see.

Money Matters Post Office Money

Web Homeowners who bought houses before December 16 2017 can deduct interest on the first 1 million of the mortgage.

. Under certain conditions you can deduct the mortgage interest you pay on your mortgage from your taxable income in Box 1 on the. Claiming the mortgage interest. Lets say you paid 10000 in mortgage interest and are.

But if not you can deduct them pro rata over the repayment period. 16 2017 then its tax-deductible on. For example if you.

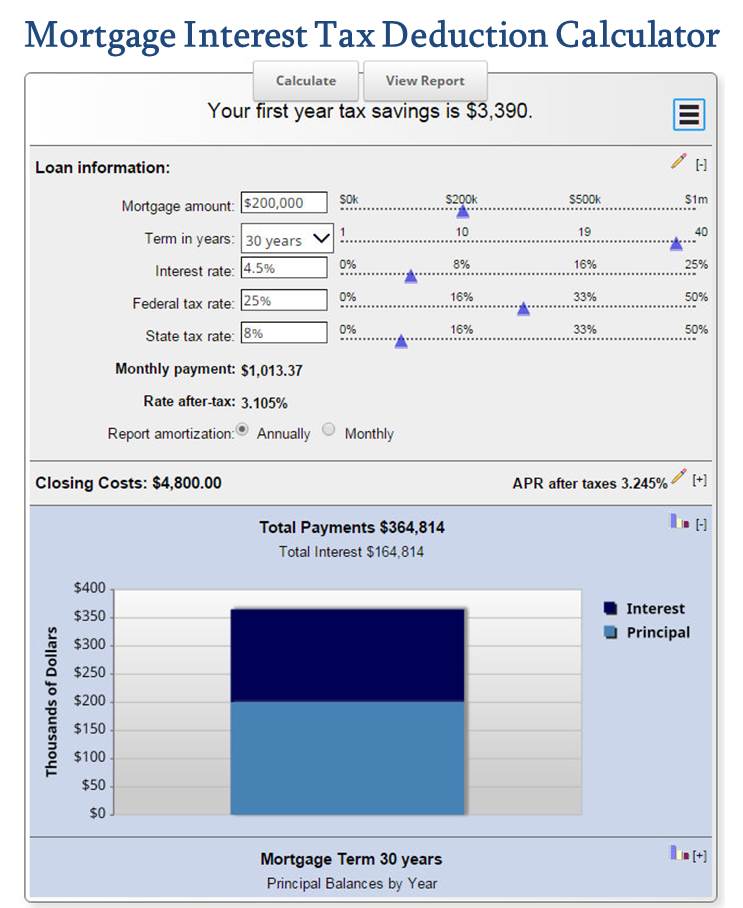

You can use this as a tool to guide your estimates. 12550 for single filing status 25100 for married. Web Use the mortgage tax savings calculator to determine how much your mortgage payments could reduce your income taxes.

Web If you want to know just how much you can deduct then try our mortgage tax deduction calculator. Web Mortgage Tax Deduction Calculator The interest you pay on your mortgage or any points you paid when you took out your loan could be tax deductible. Please note that if your.

Web This calculator helps you estimate your average tax rate for 2022-2023 your 2022-2023 tax bracket and your marginal tax rate for the 2022-2023 tax year. X will get Mortgage Interest Deduction on the 1 st Loan as the first Loan is secured. Take note that this.

Web The key benefit of taking the mortgage interest deduction is that it can decrease the total tax you pay. Web Verify your total mortgage debt. Web Mortgage interest deductions explained.

It provides you with the total interest charges tax deductions. Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec. Current tax law states that your mortgage debt must be less than 750000 in order to deduct 100 of the mortgage interest.

Web Use our Mortgage Tax Deduction Calculator to determine your mortgage tax benefit based on your loan amount interest rate and tax bracket. Web The mortgage interest deduction is a key tax provision that allows millions of homeowners to offset the mortgage interest paid each year against taxable income. Web For the 2021 tax year which will be the relevant year for April 2022 tax payments the standard deduction is.

Web These costs are usually deductible in the year that you purchase the home. Web A mortgage calculator can help you to see just how much you will be able to deduct from your loan though. Web Mortgage Tax Deduction Calculator Definitions Total Home Loan Amount.

This is the total amount of the loan that you borrowed in order to purchase your home. So the total Interest that is 1000000 5 50000 will be deducted from the total.

2022 Ktm 1290 Super Duke R For Sale At Teammoto New Bikes Teammoto Authorised Factory Dealer

Mortgage Tax Savings Calculator

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Excel Calculator Template 29 Free Excel Documents Download

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Tax Deduction Calculator Mls Mortgage

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

In7gyvwbelktrm

Answered Digitlit Math Instruction 34 18 A Bartleby

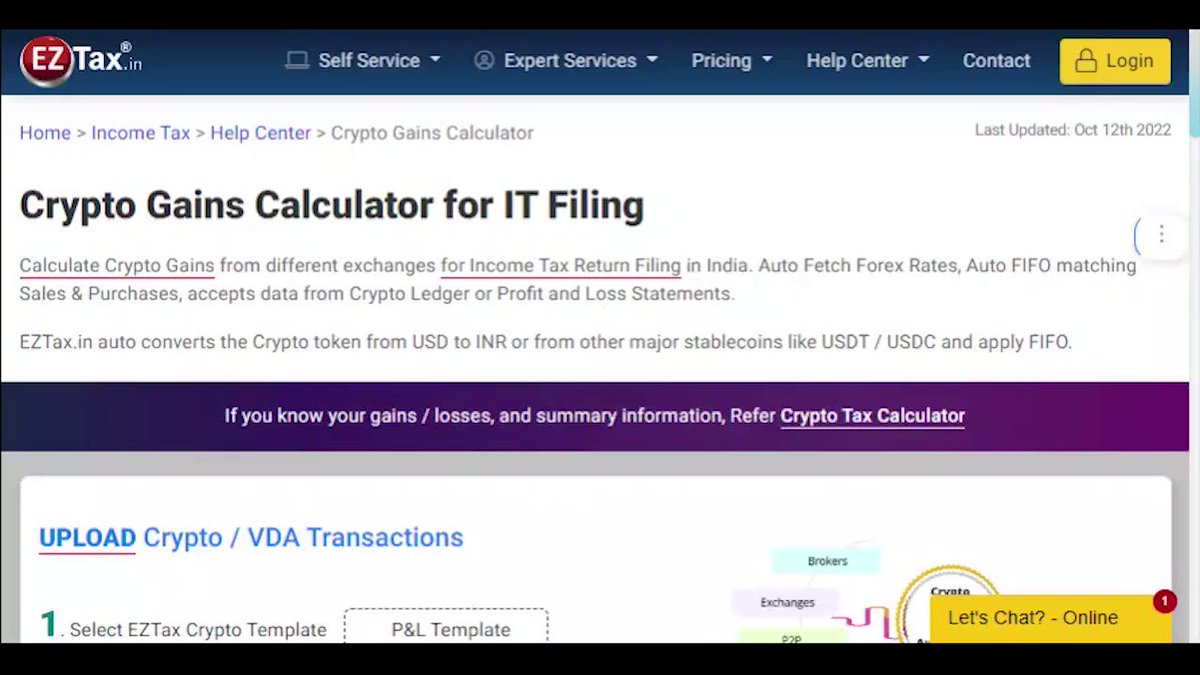

Eztax In Online It Gst Portal Eztaxindia Twitter

Mortgage Interest Tax Deduction Calculator Mls Mortgage

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

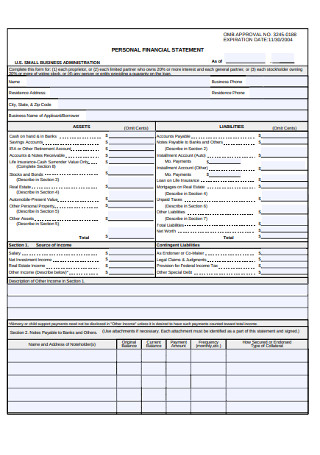

34 Sample Personal Financial Statement Templates Forms In Pdf Ms Word Excel

Mortgage Tax Calculator From Advantis Credit Union

Coming Home To Tax Benefits Windermere Real Estate

12 Finance Agreement Templates Word Pdf Docs